All Categories

Featured

There is no one-size-fits-all when it comes to life insurance coverage./ wp-end-tag > In your busy life, financial self-reliance can seem like an impossible goal.

Pension, social security, and whatever they 'd handled to conserve. But it's not that very easy today. Fewer employers are providing traditional pension and many business have actually reduced or ceased their retirement and your capacity to depend entirely on social safety remains in concern. Even if advantages haven't been decreased by the time you retire, social safety and security alone was never ever planned to be sufficient to pay for the way of living you desire and are entitled to.

/ wp-end-tag > As component of a sound economic approach, an indexed global life insurance coverage plan can assist

you take on whatever the future brings. Before dedicating to indexed universal life insurance coverage, right here are some pros and cons to think about. If you pick an excellent indexed universal life insurance plan, you might see your cash money worth grow in worth.

Index Universal Life Calculator

If you can access it at an early stage, it might be advantageous to factor it right into your. Because indexed universal life insurance policy needs a certain level of threat, insurer have a tendency to keep 6. This kind of plan additionally offers (universal life 保险). It is still assured, and you can change the face amount and motorcyclists over time7.

If the picked index doesn't perform well, your cash money worth's development will certainly be affected. Usually, the insurance policy business has a beneficial interest in executing better than the index11. There is generally a guaranteed minimum passion rate, so your strategy's development won't fall listed below a particular percentage12. These are all factors to be considered when picking the very best kind of life insurance for you.

How Does Group Universal Life Insurance Work

However, since this sort of plan is more complex and has an investment component, it can often include greater costs than various other policies like whole life or term life insurance coverage. If you don't think indexed global life insurance policy is best for you, here are some alternatives to consider: Term life insurance policy is a temporary policy that typically provides insurance coverage for 10 to three decades.

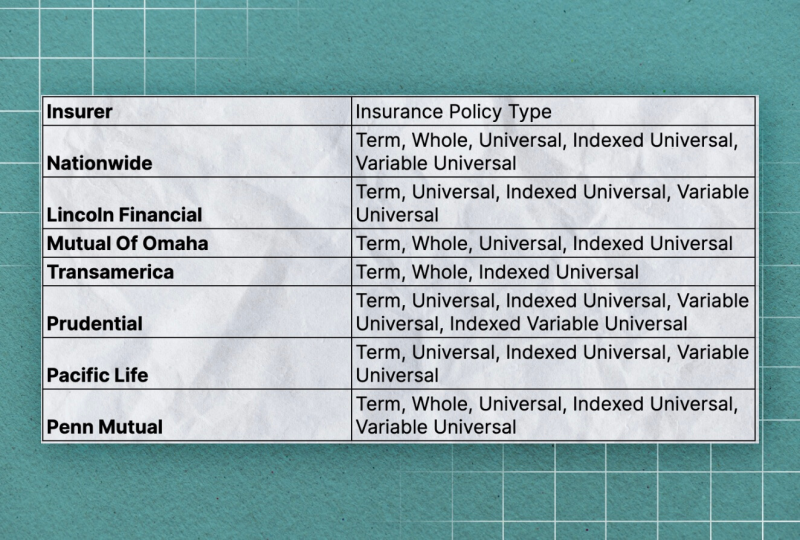

When determining whether indexed global life insurance policy is ideal for you, it is necessary to consider all your choices. Whole life insurance policy may be a much better option if you are seeking even more security and consistency. On the other hand, term life insurance policy may be a much better fit if you only require insurance coverage for a particular amount of time. Indexed universal life insurance policy is a sort of plan that provides much more control and versatility, along with higher money value development capacity. While we do not use indexed universal life insurance policy, we can provide you with more info regarding whole and term life insurance policy policies. We recommend exploring all your choices and talking with an Aflac representative to discover the best fit for you and your family members.

The rest is included in the cash value of the plan after charges are deducted. The money value is attributed on a month-to-month or annual basis with interest based upon increases in an equity index. While IUL insurance coverage may show valuable to some, it is very important to understand exactly how it functions before acquiring a plan.

Latest Posts

Universal Life Safety Products

Equity Indexed Universal Life Insurance Contracts

What Is Indexed Universal Life Insurance